18 January 2025

Let’s face it: technology has been a game-changer in nearly every aspect of our lives. From how we shop and communicate to how we work and even invest, it’s safe to say that the digital revolution is steering the wheel. Nowhere is this shift more noticeable than in finance — specifically, in asset allocation.

If you’ve been tinkering with your portfolio or even just considering dipping your toes into investing, you’ve likely run into the buzz around algorithms, artificial intelligence, and robo-advisors. But what’s really going on behind the scenes? How is technology reshaping the way we allocate assets? Buckle up, friend, because we’re about to dive deep into this evolving landscape.

What is Asset Allocation Anyway?

Okay, before we get into the tech stuff, let’s get our basics straight. Asset allocation is like building the perfect smoothie — a mix of ingredients (stocks, bonds, cash, real estate, etc.) to create a portfolio that aligns with your goals, risk tolerance, and timeline. It’s all about spreading your investments in a way that balances risk and reward.Remember that old saying, “Don’t put all your eggs in one basket”? That’s basically the foundation of asset allocation. But here’s the kicker: technology is completely changing how we decide which baskets to use and how many eggs to put in each.

The Role of Data: The Fuel Behind Tech-Driven Allocation

You’ve probably heard this phrase a million times: “Data is the new oil.” And in asset allocation, it's absolutely true. With tech advances, investment firms now have access to a firehose of data — historical market trends, economic indicators, sentiment analysis, social media chatter, and even weather patterns (yes, really).Big Data Meets Asset Allocation

Think about it: humans can only analyze so much information before our brains hit a hard stop. But machines? They can process millions of data points in the blink of an eye. Algorithms powered by big data can identify patterns and correlations that would take humans years to figure out.For example, let’s say you’re trying to decide if investing in renewable energy stocks is a good idea. Traditional methods might involve analyzing past performance, reading financial reports, and staying updated on industry news. But technology can take it a step further by predicting future trends based on thousands of variables, like global energy demand, government policies, and even public sentiment.

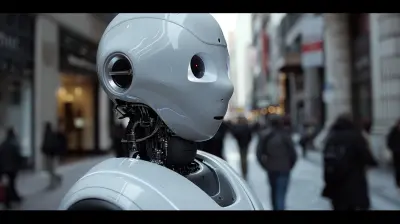

Enter Artificial Intelligence: The Smart Investor’s Best Friend

Ah, AI. The buzzword we can’t escape. Artificial intelligence is like having a super-smart assistant who never sleeps. It’s revolutionizing asset allocation by taking things beyond just crunching numbers. AI can actually think (well, sort of) and make decisions based on probabilities, patterns, and predictions.Personalized Portfolios at Scale

Imagine walking into a tailor who can make a suit that fits perfectly — down to the last millimeter. That’s what AI can do with your investment portfolio. By analyzing your goals, risk tolerance, and even spending habits, AI can suggest an asset allocation strategy that’s completely personalized. And here’s the cherry on top: it does this at scale. Whether you’re managing $1,000 or $10 million, AI doesn’t break a sweat.Real-Time Portfolio Adjustments

Markets move fast — like, lightning-fast. One tweet from Elon Musk can send crypto prices skyrocketing or tumbling. AI can monitor markets 24/7 and make real-time adjustments to your portfolio. No more waking up to unpleasant surprises because you missed a late-night market move.

Robo-Advisors: The Rise of the Digital Money Managers

If you’ve ever googled “best ways to invest,” chances are you’ve come across robo-advisors. These digital platforms are powered by algorithms and offer low-cost, automated investment advice. Robo-advisors use technology to create and manage portfolios without the need for human intervention (or those hefty advisory fees).Why Are Robo-Advisors So Popular?

Let’s be real — not everyone is a finance nerd who loves digging into spreadsheets and market reports. Robo-advisors simplify the process by automating everything from asset allocation to rebalancing. It’s like having a personal finance assistant that works tirelessly in the background so you can focus on binge-watching your favorite shows.Plus, they’re ridiculously cost-effective. Most charge a fraction of what traditional financial advisors do, which means more of your money stays in your portfolio, where it belongs.

Are Humans Becoming Obsolete in Investing?

Not so fast. While robo-advisors are convenient and efficient, they’re not perfect. They can’t always factor in the emotional and behavioral aspects of investing (like that panic you feel during a market downturn). That’s where human advisors still hold their ground. But even they are incorporating technology to offer hybrid solutions.Blockchain and Asset Allocation: A Match Made in Tech Heaven

Let’s talk blockchain. You’ve probably heard about it in the context of cryptocurrencies like Bitcoin, but its potential goes way beyond digital coins. Blockchain brings transparency, security, and efficiency to asset allocation.Tokenization: Breaking Down Investments

Here’s a cool concept: tokenization. Imagine owning a tiny fraction of a luxury hotel or a Picasso painting. Blockchain makes this possible by breaking down large, illiquid assets into smaller, tradeable units. This opens up investment opportunities to a broader audience.In terms of asset allocation, tokenized assets can add diversity to your portfolio without requiring massive upfront capital. It’s a win-win.

Machine Learning and Predictive Analytics: Peeking Into the Future

If you had a crystal ball to see into the future, would you peek? That’s essentially what machine learning and predictive analytics do for asset allocation. By analyzing historical data and recognizing patterns, these technologies can offer insights into how different assets might perform under various scenarios.For instance, machine learning can help investors answer questions like:

- How would my portfolio hold up during a recession?

- What happens if inflation spikes?

- Should I allocate more to emerging markets or stick with developed economies?

By running these “what-if” scenarios, investors can make more informed decisions.

Gamification: Making Asset Allocation Fun

Investing used to be intimidating, right? But technology has even managed to make asset allocation… fun? Yes, you read that right. Platforms like Robinhood and Acorns use gamification to engage investors, especially younger ones.Rewards, badges, interactive charts — these features make investing feel less like work and more like a game. And guess what? Gamification isn’t just for entertainment. It can actually encourage better financial habits, like consistent investing and diversification.

Challenges of Tech-Driven Asset Allocation

Okay, so technology sounds amazing, but it’s not all rainbows and unicorns. Let’s talk about some of the challenges.Over-Reliance on Algorithms

Algorithms are only as good as the data they’re fed. If the data is biased or incomplete, the results can be skewed. Plus, algorithms can’t predict black swan events — those rare, unpredictable events that can shake up markets (hello, 2020 pandemic).Privacy and Security Concerns

With so much of our financial lives going digital, cybersecurity is a big concern. Hackers are always on the prowl, and one data breach could be disastrous for investors.Loss of Human Touch

As more investors embrace tech-driven solutions, there’s a growing debate about the loss of the human touch in financial advising. While technology can do a lot, it can’t replace the empathy and understanding that a human advisor brings to the table.The Future of Asset Allocation: What’s Next?

So, where do we go from here? It’s safe to say that technology will continue to play a central role in asset allocation. Expect to see even more advanced AI, blockchain innovations, and personalized investing solutions.But remember: technology is a tool, not a replacement for good old-fashioned common sense. The best approach is often a blend of human intuition and tech-driven insights.

Final Thoughts: Riding the Tech Wave

There’s no denying it — technology is changing the game for asset allocation. It’s making investing more accessible, efficient, and personalized. Whether you’re a seasoned investor or a complete newbie, there’s never been a better time to take advantage of these innovations.But as exciting as these advancements are, it’s crucial to stay informed and never let technology completely replace your own judgment. After all, even the best algorithms can’t fully predict the future. So, embrace the tech, but always keep your wits about you.

Maria Henderson

This article sheds light on the transformative impact of technology on asset allocation. It's fascinating to see how data analytics, AI, and automation can enhance decision-making and optimize portfolios. I’m curious about future trends—how might emerging tech further reshape investment strategies in the coming years?

April 1, 2025 at 10:31 AM