Market Insights: Post-Election Trends and Economic Shifts

December 3, 2024 - 06:02

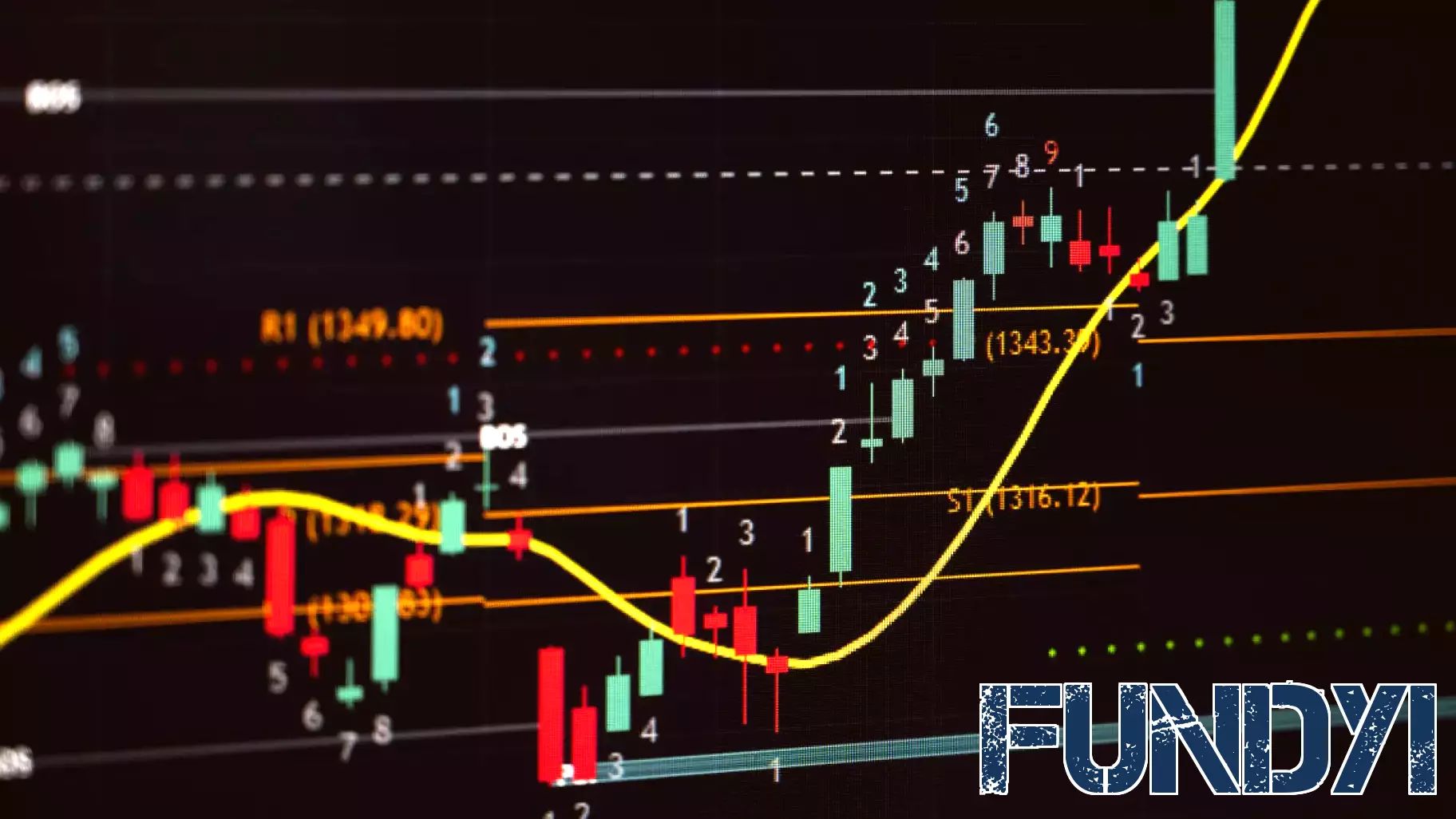

As December begins, market analysts are closely examining the recent trends following the elections. The stock market has shown notable momentum, reflecting investor sentiment and confidence in the political landscape. This post-election phase often brings about volatility, but current indicators suggest a cautious optimism among traders.

One significant factor is the rising strength of the US dollar, which has implications for both domestic and international markets. A stronger dollar can impact export competitiveness and influence inflation rates, prompting discussions about potential risks ahead. Investors are advised to monitor these shifts closely, as they can affect various sectors differently.

Additionally, the landscape of interest rates is evolving, with expectations of future adjustments by the Federal Reserve. As the economy continues to recover, the potential for rate hikes looms, which could further shape market dynamics. Overall, these developments highlight the need for vigilance and adaptability in investment strategies as the year draws to a close.

MORE NEWS

March 3, 2026 - 06:03

Majority of Women Now Are the Chief Financial Officer of Their Household, Allianz Life Study FindsA significant shift in domestic financial management is underway, with a new study revealing that the majority of women now identify as the primary financial decision-maker for their homes. This...

March 2, 2026 - 04:02

As Coinbase Rolls out 24/5 Stock Trading, Should You Snap up COIN?The digital asset exchange Coinbase is making a significant move into traditional finance, launching a new service that allows its users to trade U.S. stocks and exchange-traded funds (ETFs) around...

March 1, 2026 - 11:06

The Future of Finance – The Path to Your AI Operating SystemThe traditional role of finance as a historical scorekeeper is rapidly becoming obsolete. Industry leaders now champion a profound shift, positioning the finance function as a proactive strategic...

February 28, 2026 - 19:40

They Asked What Owning Just 1 BTC Would Do For Someone's Financial Life. Some Called It Life-Changing, Others Joked, 'It Means I'm Down $30K'Owning one full Bitcoin sounds like a milestone. But when a user recently asked what having just one Bitcoin would actually do for someone`s financial life, the answers were anything but unanimous....