February 23, 2025 - 19:29

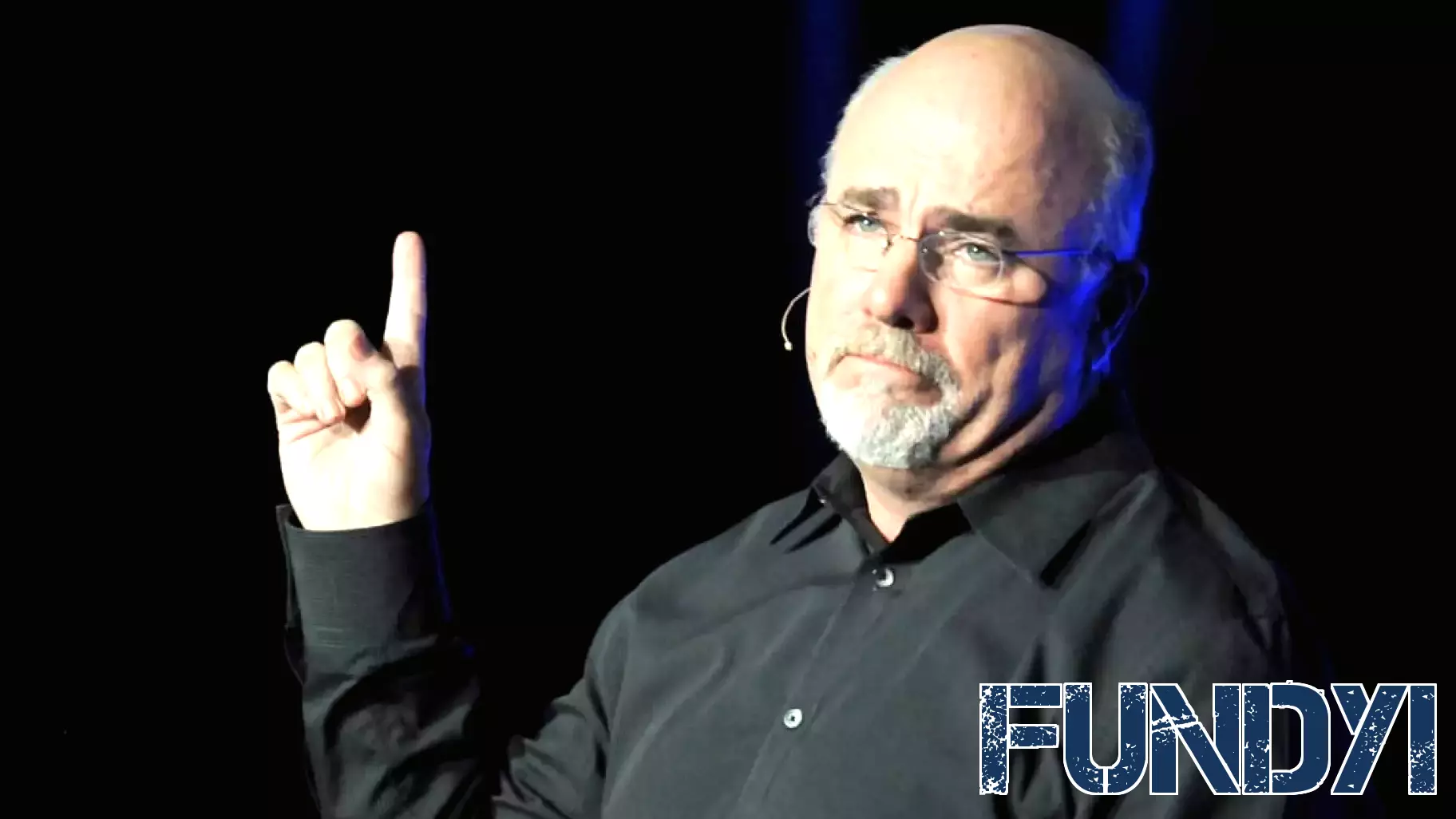

In a recent discussion, a prominent personal finance author highlighted significant concerns regarding the future of retirement savings for many Americans. The expert pointed out that both 401(k) plans and Social Security may face challenges that could jeopardize the financial security of retirees.

With rising inflation and market volatility, the reliability of 401(k) plans is increasingly under scrutiny. Many individuals may not be adequately prepared for the reality of market fluctuations impacting their retirement funds. The author emphasized the importance of diversifying retirement savings and not solely relying on employer-sponsored plans.

Additionally, the future of Social Security remains uncertain, with projections indicating that the program may face funding shortfalls in the coming years. This could lead to reduced benefits for future retirees, leaving many without the safety net they anticipated.

As the landscape of retirement funding evolves, the expert urges Americans to take proactive steps in planning for their financial futures, ensuring they are not caught off guard by potential pitfalls.