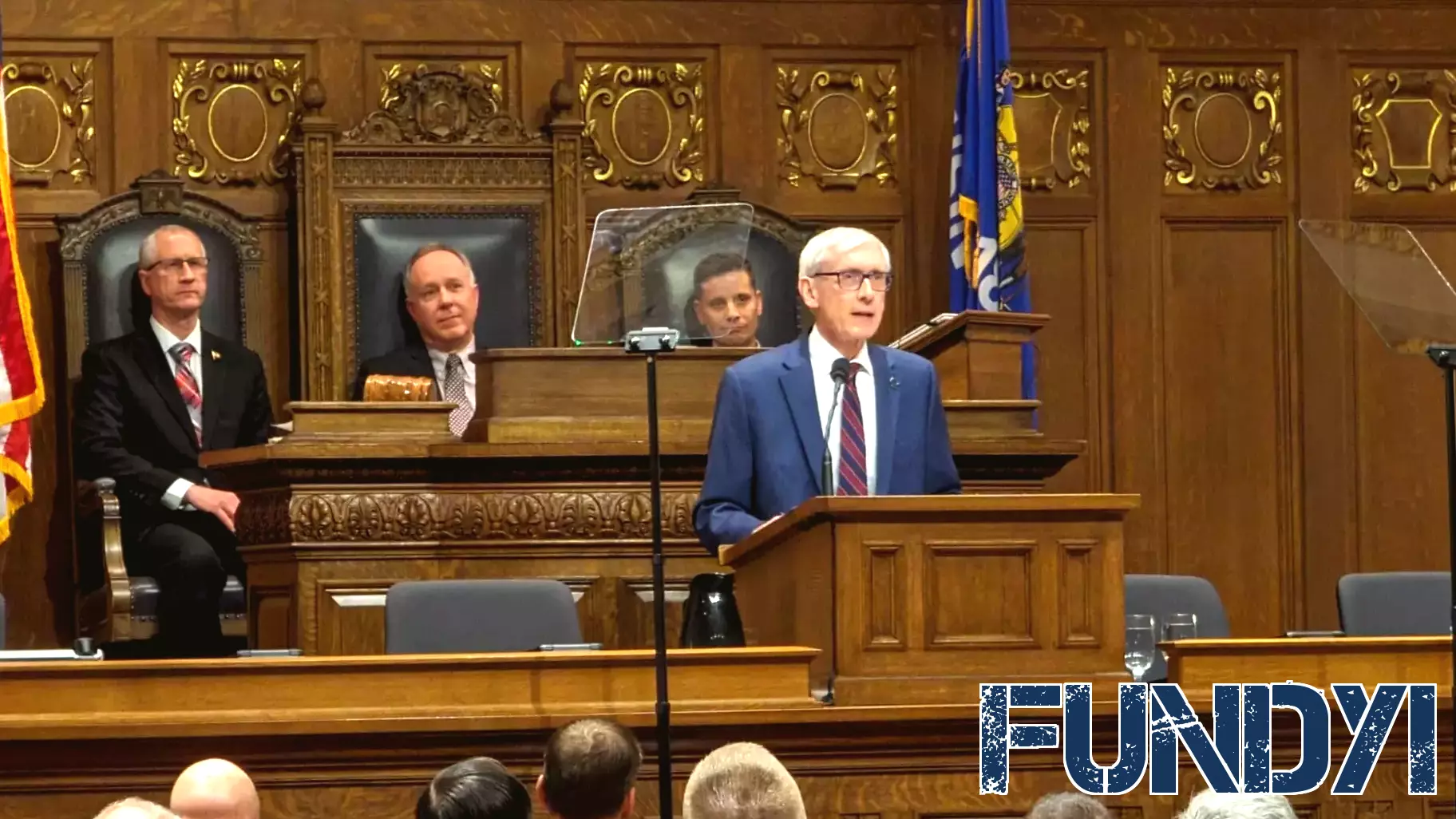

Wisconsin Reports Impressive $4.5 Billion Budget Surplus

December 21, 2024 - 22:06

Wisconsin has announced a remarkable budget surplus of $4.5 billion for the fiscal year, highlighting the state's strong financial position. This surplus is a significant indicator of the state's economic health and reflects prudent fiscal management over the past years. In addition to the general fund surplus, Wisconsin's Budget Stabilization Fund, often referred to as the rainy day fund, concluded the year with a robust balance of $1.9 billion.

This financial cushion is particularly important as it prepares the state for any unforeseen economic challenges that may arise in the future. The surplus allows for potential investments in public services, education, and infrastructure, which could further stimulate the state's economy. State officials are optimistic about the prospects for continued growth and stability, emphasizing the importance of maintaining a balanced budget while also considering tax relief options for residents. The surplus represents a unique opportunity for Wisconsin to enhance its financial resilience moving forward.

MORE NEWS

March 9, 2026 - 03:55

Tech Stocks Emerge as Safe Haven Amid Geopolitical Market TremorsAs global markets experience heightened volatility following escalating tensions between the United States and Iran, a notable shift is occurring on Wall Street. Investors, seeking shelter from the...

March 8, 2026 - 10:47

Sony hack: Former CEO shares the untold storyMichael Lynton, now Chairperson of Snap Inc., has provided a gripping firsthand account of the 2014 Sony Pictures hack, revisiting one of the most shocking security breaches in corporate history....

March 7, 2026 - 22:55

International Investment Funds Surge Ahead in Early 2026 PerformanceGlobal equity markets are witnessing a notable shift in momentum as international investment funds have jumped to an early lead in 2026. Currently boasting an average gain of 9.3%, these non-U.S....

March 7, 2026 - 08:43

‘It matters to all of us’: Oregon financial wellness report shows people strugglingA newly released state report paints a concerning picture of economic hardship across Oregon, indicating a growing number of residents are struggling to achieve financial security. The Oregon...